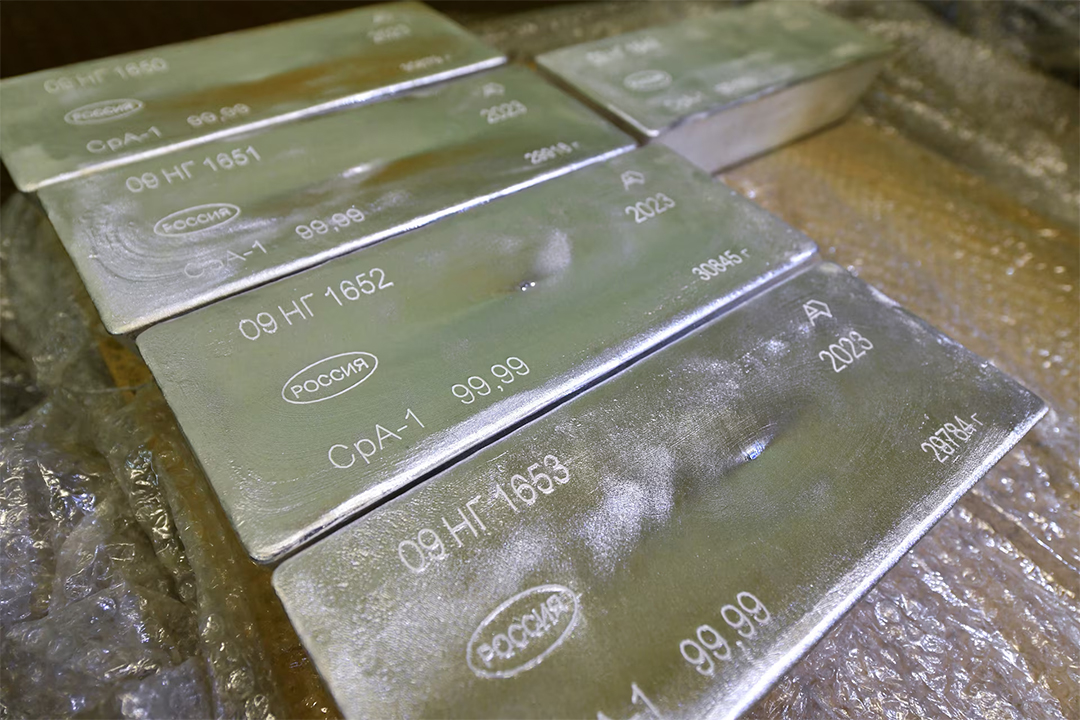

Gold did well in 2025, but silver and platinum blew past it. Silver jumped 143% and platinum 137%.

Silver prices hit $80/oz for the first time ever. Retail and industrial demand really pushed it, plus ETFs have been pouring in. Solar panels and EVs are gobbling up metal, leaving less in the physical market.

BMI, part of Fitch Solutions, expects the silver deficit to continue in 2026. They said high investment demand will keep pressure on prices.

“As non-yielding assets, silver and platinum got a lift from rate cuts,” BMI noted. “Also, gold being high made them look cheap in portfolios, for jewelry, and industrial uses.”

Prices are still volatile though. Speculators move the market. Central banks? Not really a factor for silver.

Supply Issues

Beijing limited silver exports, which has tightened inventories in London and Zurich. Lease rates for silver spiked above 8% briefly. Mexico, the biggest silver producer, isn’t adding much either. Ore grades are down and Fresnillo’s San Julián mine slowed operations.

Platinum Rally

Platinum hit $2,000/oz after the EU postponed its 2035 ICE ban. That news on December 16 drove prices to $2,471/oz by December 26 a huge spike. But then on December 29, prices dropped nearly 15%, the biggest daily drop since 2001.

BMI expects only modest industrial demand growth for platinum in 2026. Recycling will offset some of the lower mine production from South Africa. Analysts think current platinum prices may not match the fundamentals, even with the recent rally.