Mining & Resources

-

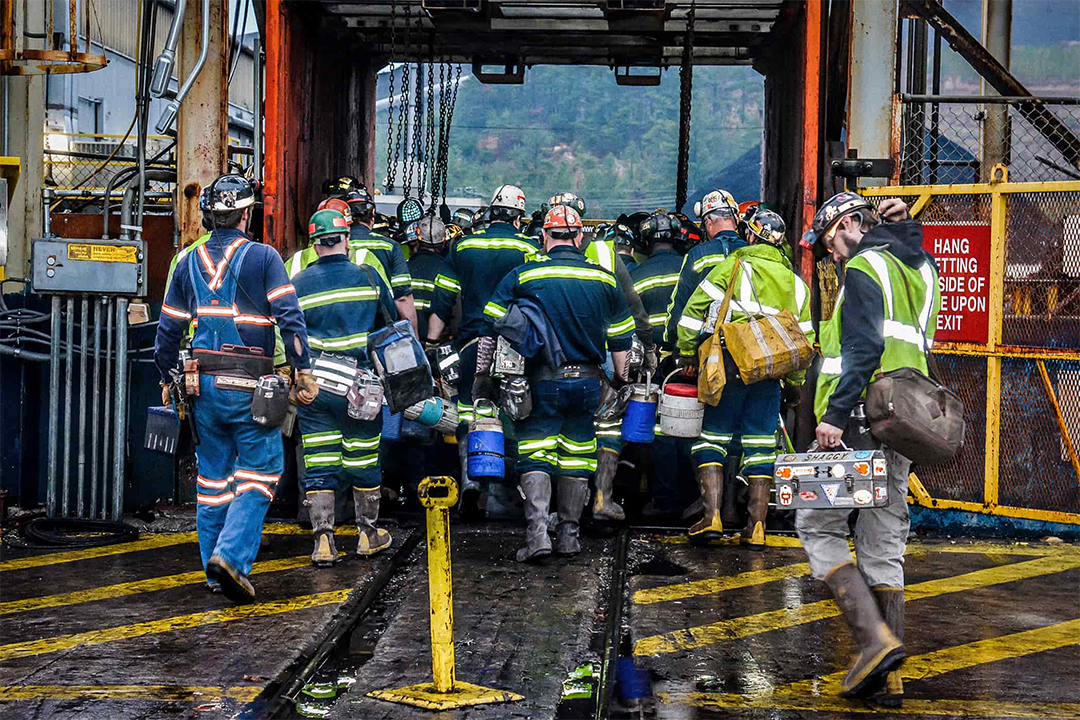

First Quantum Unlocks Cobre Panama Stockpile, Driving Copper Output

First Quantum Minerals (TSX: FM) got a big break this week. Panama’s President Jose Raul Mulino gave the nod to allow the company to process ore that’s been sitting at its idle Cobre Panama mine since operations stopped in 2023. It’s not a full reopening, but it’s a start toward stabilizing the site. The company

-

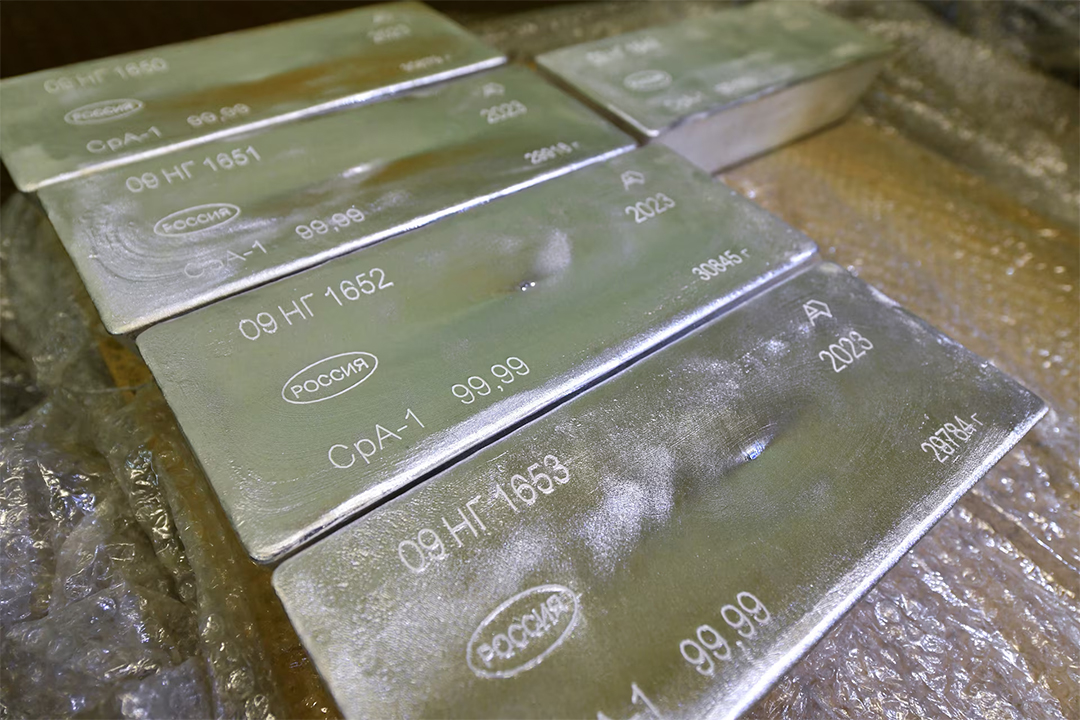

From Scarcity to Security: US Mineral Plan

A group of US lawmakers, both Democrats and Republicans, introduced a bill on Thursday to set up a $2.5 billion stockpile of critical minerals. The idea is to reduce reliance on China, which controls a lot of the supply chain, according to Reuters. The bill is meant to help stabilize prices for minerals used in

-

Australia Steps Up Challenge to China’s Critical Minerals Hold

Australia is finally putting real money into critical minerals. The government plans to spend A$1.2 billion, about $800 million, to buy key minerals from local producers. They will hold them in a strategic reserve. The goal is simple. Secure supply for defense and high-tech industries. Support local miners. Reduce reliance on China. China still controls