Crypto & Fintech

-

Stablecoins Went Mainstream in 2025 and Are Powering Tokenized Asset Growth

Stablecoins quietly became crypto’s most useful product in 2025. They crossed over into the real world in a way few other crypto ideas ever have. Now the industry is trying to build on that momentum. The pitch for 2026 is simple enough: if dollars can live onchain, why not stocks, funds, or even gold? That

-

ETH: The Silent Backbone of the Growing Stablecoin Market

Stablecoins. They used to be simple. Park your dollars between trades, don’t touch fiat. Easy. Now, it feels different. BlackRock, in their 2026 Global Outlook, is treating them like the rails of the financial system. Not just crypto anymore. Expanding Into Mainstream Finance They say stablecoins are moving beyond exchanges. Into payments, cross-border transfers, even

-

Investor Protection at Risk? Warren Questions SEC on Crypto Integration

Senator Elizabeth Warren has asked the SEC to clarify how it will protect investors as cryptocurrency and other alternative assets start appearing in 401(k) and other retirement accounts. Her request follows an executive order from August 2025 that encouraged federal regulators to make alternative assets, like crypto and private equity, easier to access. Concerns About

-

U.S. Lawmakers Push Crypto Bill, But Nothing Is Certain

Late Monday, a group of U.S. senators unveiled a draft bill aimed at bringing some clarity to the crypto market. If it becomes law, it would set a federal framework, basically spelling out which regulators handle what. Could be good for adoption. Could also be a long road. Tokens and Legal Gray Areas The bill

-

JPMorgan Wraps Up Big Year, Warns of Risks Ahead

JPMorgan Chase (JPM) reported fourth-quarter earnings Tuesday, wrapping up a record year even though its Apple Card deal with Goldman Sachs cut into profits. The bank made $13 billion in net income for the quarter, which included $2.2 billion in expected losses from the deal. Without those costs, net income would have been $14.7 billion.

-

Wells Fargo Slides Despite Q4 Earnings Beat

Wells Fargo said fourth-quarter profit came in above Wall Street estimates, but the stock fell in premarket trading after interest income missed expectations. Net income for the quarter was $5.36 billion, or $1.62 per share, compared with $5.08 billion, or $1.43 per share, a year earlier. On an adjusted basis, the bank earned $1.76 per

-

Bank of America Reports $7.6B Q4 Profit; Interest Income Lifts Results

Bank of America (BAC) beat fourth-quarter earnings expectations, helped by strong trading in volatile markets and record interest income. Shares were up around 2% in premarket trading. Net income came to $7.6 billion, or 98 cents per share, up from $6.8 billion, or 83 cents a year earlier. Analysts were expecting 96 cents per share.

-

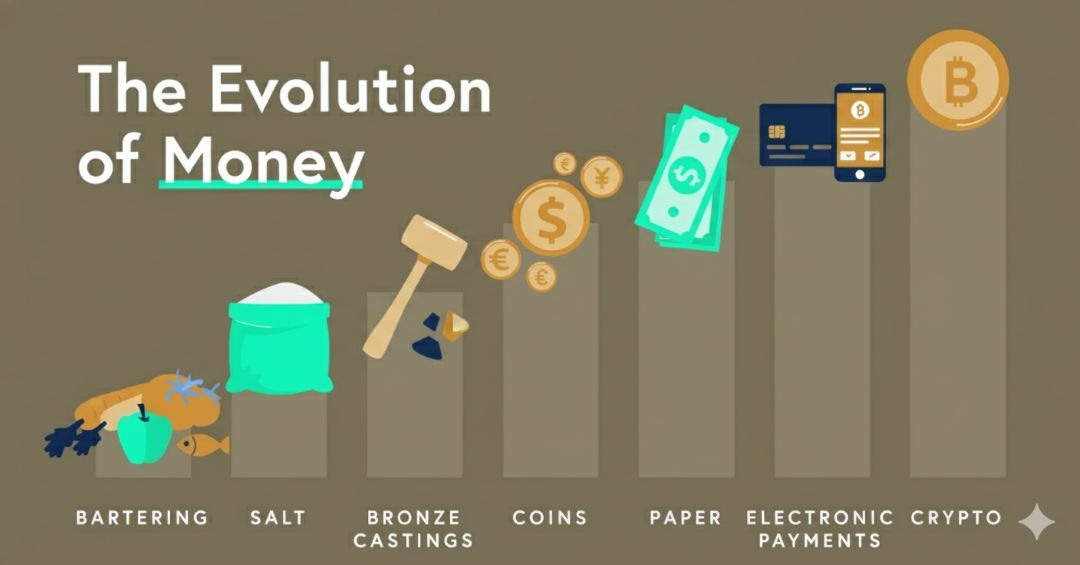

Digital Currencies and the Future of Banking

Central banks, financial firms, and technology companies are moving toward a more digital monetary system. Cryptocurrencies, stablecoins, and central bank digital currencies offer alternative mechanisms for payments and value storage. These technologies could reduce frictions in cross-border settlement, expand financial access, and enable new financial services. They also introduce serious tradeoffs in security, privacy, and